The ability to quickly and accurately analyze investment deals is the key to unlocking profitable ventures. Whether you’re an experienced investor or just starting your journey, mastering the art of real estate deal analysis is crucial for making informed decisions and avoiding costly mistakes.

This guide outlines a proven 5-step process for identifying profitable real estate investments, highlights essential tools, and helps you steer clear of common pitfalls.

Why Real Estate Deal Analysis is Critical in Real Estate Investing

Deal analysis forms the foundation of successful real estate investing. It empowers investors to:

Objectively evaluate potential opportunities with clear data

Compare multiple properties efficiently, saving time

Identify hidden costs and risks that could impact profitability

Make data-driven decisions that maximize return on investment (ROI)

In real estate, you make money when you buy, not when you sell. Thorough deal analysis ensures you’re buying right. — Adan Ordoñez.

Step 1: Gather Comprehensive Property Information and Market Data

The first step in analyzing any real estate deal is collecting accurate, detailed information about both the property and its surrounding market. This data lays the groundwork for your investment analysis.

Key data points to gather:

- Property details: Size, age, condition, and unique features

- Sales history: Recent sale prices of comparable properties (comps)

- Rental rates: Current and historical rental prices in the area

- Market trends: Local economic indicators, housing demand, and supply

- Neighborhood data: Demographics, future development plans, and infrastructure projects

Pro Tip: Leverage sources like the MLS (Multiple Listing Service), public records, and real estate association reports to gather this data efficiently.

Step 2: Analyze the Purchase Price and Estimate Rental Income

After collecting property data, dive into the financial aspects of the deal. This step helps you determine whether the property price and potential rental income align with your investment goals.

Analyzing the Purchase Price:

- Compare recent sales of similar properties in the neighborhood to ensure you’re not overpaying.

- Account for renovation costs or repairs that could influence the total investment.

Estimating Rental Income:

- Research rental rates for comparable properties in the area.

- Factor in vacancy rates to ensure accurate income projections.

Tip: Our free Investment Property Calculator simplifies this process by helping you quickly estimate rental income and compare purchase prices.

Step 3: Calculate Operating Expenses and Net Operating Income (NOI)

Understanding the ongoing costs of owning a property is vital to avoid surprises down the line. Accurately estimating operating expenses is key to calculating your NOI—a critical measure of a property’s profitability.

Common Operating Expenses:

- Property taxes

- Insurance

- Maintenance and repairs

- Property management fees

- Utilities (if not tenant-paid)

Calculating NOI:

To calculate the Net Operating Income (NOI), subtract your total operating expenses from the estimated rental income:

NOI = Total Rental Income – Total Operating Expenses

Step 4: Determine Capitalization Rate and Cash-on-Cash Return

Once you’ve calculated NOI, it’s time to assess the property’s profitability using key financial metrics such as the **Capitalization (Cap) Rate** and **Cash-on-Cash Return**. These metrics allow you to compare different investment opportunities and make more informed decisions.

Capitalization Rate (Cap Rate):

Cap Rate helps you determine the return on investment relative to the property’s price:

Cap Rate = (NOI / Purchase Price) x 100

Cash-on-Cash Return:

This metric measures your annual return based on the cash you’ve invested:

Cash-on-Cash Return = (Annual Cash Flow / Total Cash Invested) x 100

Our Real Estate Deal Analyzer tool simplifies these calculations, allowing you to compare multiple properties in real time.

Step 5: Explore Value-Add Opportunities and Exit Strategies

Savvy investors don’t just focus on the current state of a property—they look for opportunities to enhance its value and have clear exit strategies.

Value-Add Opportunities:

- Renovations or upgrades that increase rentability

- Improving property management for better efficiency and cost savings

- Rezoning or reconfiguring the property for higher use

Exit Strategies:

- Always have multiple strategies in place to protect your investment:

- Long-term hold for rental income and appreciation

- Fix-and-flip for quick profits after renovations

- Wholesale for assigning deals without ownership

> The best deals often have hidden potential. Always look for ways to add value and plan your exit strategies ahead of time. – Grant Cardone, Real Estate Investor and Author

Essential Tools for Real Estate Deal Analysis

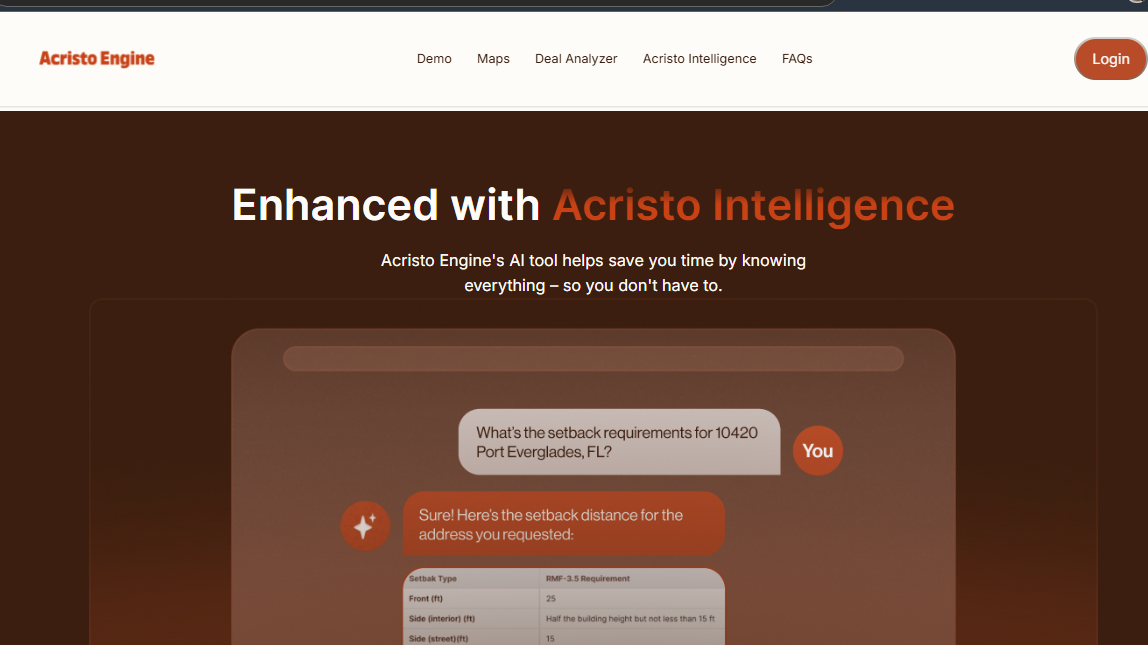

While our free calculators are a great start, serious investors can benefit from more robust tools. Our all-in-one real estate investment software streamlines every aspect of deal analysis with features such as:

Automated data collection from multiple sources

Advanced financial modeling and profit projections

Scenario analysis to test different investment strategies

Custom reporting and visualization tools to present data clearly

Acristo Engine Real Estate Investment Software

With these tools, you can analyze potential investments faster and with greater accuracy, giving you a competitive edge.

Common Pitfalls in Real Estate Deal Analysis

Even experienced investors can make mistakes. Avoid these common pitfalls:

1. Overestimating rental income without solid market research

2. Underestimating operating expenses, leading to lower profits

3. Ignoring vacancy rates, which can overinflate projections

4. Neglecting future market changes that impact property value

5. Not accounting for the time value of money, skewing long-term ROI calculations

Our real estate investment software helps mitigate these risks by offering real-time data analysis and customizable projections.

Make Informed, Data-Driven Investment Decisions

Successful real estate investing comes down to making informed, data-driven decisions. By following our 5-step process and utilizing powerful tools, you can confidently identify and invest in profitable properties.

Ready to elevate your deal analysis skills? Try for free Acristo Engine Software today and apply these techniques to your next investment.